XBRL in practice

The XBRL standard is not used properly and provides thresholds rather than easier collaboration. XBRL describes messages with which financial reports are exchanged between systems. XBRL is used in the Netherlands by the government and banks in the context of Standard Business Reporting (SBR).

The tax authorities use XBRL messages for tax declarations. The Chamber of Commerce has messages for filing the annual reports of companies. Banks have developed XBRL messages around the application for business loans.

XBRL specifications

Few professionals understand the complex XBRL specifications, which can consist of thousands of files. Only with special tooling one can browse through a specification, while often special, very expensive software must be used to send XBRL messages.

The XBRL specifications are made by a very limited group of specialists and an understandable, functional description is not supplied. Therefore, their work cannot be checked. This leads to high costs for implementation and management, errors and a difficult adaptation of XBRL.

Examples of errors can be found, for example, at the Dutch Tax Authorities where amounts are defined differently in the VAT message than in the Corporation tax message.

Moreover, the market for XBRL is in the hands of a limited group of companies that have built up a position in the early years of XBRL. Large companies therefore pay very high costs, while small parties do not build according to specifications, but according to trial and error based on sample messages.

What we do

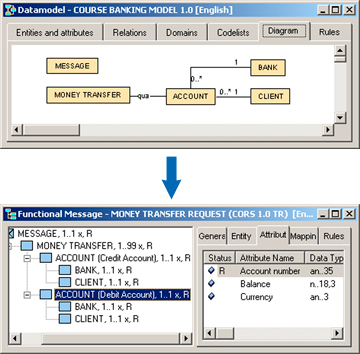

EC-XBRL is Digitect's vision to solve this problem by starting from functional descriptions and applying the XBRL standard as simply as possible:

- Maintain a functional data model with which all messages are consistently defined;

- A complete, comprehensible, functional specification is automatically supplied with every technical XBRL message, so that the content of the messages can be understood and checked by everyone;

- The XBRL specifications are kept as simple as possible, so that implementation becomes simple.

EN

EN NL

NL